David Murdock:

Sun in Aries - opposite - Saturn in Libra

http://business-moguls.blogspot.com/

Saturn Opposite Sun:

Extremely critical deep distrust of the world with desire to gain control (Saturn)

The opposition aspect is extremely powerful and places the planets in conflict with each other, producing difficulties, but increasing the range of possibilities open to the individual.

Constructive Saturn in Libra:

Saturn will be looking for balance, integrity, and fairness in the sign of Libra

Destructive Saturn in Libra:

Tendency to blame an issue with Saturn in Libra

- David Murdock

4/10/1923 Kansas City MO

Jupiter@17 Scorpio 00

Semi-Sextile

Saturn@16 Libra 32 rx

Challenged to perceive the big picture, understands conflict of the planetary functions involved. 'Necessity the mother of invention' in existing circumstances brings out latent creative potential.

Initiating the absolute potential for massive growth, as a personal force of nature, with fundamental, indomitable expectations assumes intrepid risk-taking; attributes the most valuable commodity, an unstoppable confidence that can not be infringed upon or violated under harsh or tough circumstances

Real estate tycoon - Castle & Cooke

http://mogul-1.blogspot.com/

http://en.wikipedia.org/wiki/David_H._Murdock

http://littlesis.org/person/15035/David_Murdock

Asteroid Analysis, David Murdock

Mercury @22 Aries

sextile

Silver (persuasive, having to do with money or silver) @22 Aquarius

Jupiter @17 Scorpio

square

Damocles (crisis, to'push it') @16 Aquarius

Saturn @16 Libra

trine

Damocles (crisis, to 'push it') @16 Aquarius

Uranus @15 Cancer

conjunct

Caesar (imperialistic ambition, aiming for conquest) @15 Cancer

Pluto @09 Cancer

conjunct

Midas (making money) @08 Cancer,

Ouro Preto (the dark side of money) @08 Cancer

trine

Gold (gold or money in general) @08 Pisces,

Prey (plunder, exploit, prey upon) @09 Pisces,

Mony (money, insurance) @08 Scorpio

Eris @29 Pisces

quincunx

Hidalgo (assertion, promoting self or others, ambition) @29 Libra

Parties Responsible:

- Regulators who stood by as U.S. banks developed ingenious but dangerous ways of shifting trillions of dollars of credit risk off their balance sheets and into the hands of unsophisticated foreign investors;

- Hedge and pension fund managers who gorged on high-yield debt instruments they didn't understand;

- Financial engineers who built towers of "securitized" debt with math models that were fundamentally flawed. - Jon Markman

http://business-moguls.blogspot.com/

Goldman Sachs

http://mogul-15.blogspot.com/

Update:

The IMF both bears much of the blame for the imbalances in the world economy and then for failing to clearly sound the alarms about the dangers of the bubble. While the IMF has no problem warning about retired workers getting too much in Social Security benefits, it apparently could not find its voice when the issue was the junk securities from Goldman Sachs or Citigroup that helped to fuel the housing bubble.

The collapse of this bubble has not only sank the world economy, it also destroyed most of the savings of the near retirees for whom the IMF wants to cut Social Security. The vast majority of middle-income retirees have most of their wealth in their home equity. This home equity largely disappeared when the bubble burst.

The average Social Security benefit is just under $1,200 a month. No one can collect benefits until they reach the age of 62. By contrast, many IMF economists first qualify for benefits in their early 50s. They can begin drawing pensions at age 51 or 52 of more than $100,000 a year.

This means that we have IMF economists, who failed disastrously at their jobs, who can draw six-figure pensions at age 52, telling ordinary workers that they have to take a cut in their $14,000 a year Social Security benefits that they can't start getting until age 62.

Dean Baker, co-director Center for Economic and Policy Research in Washington, DC.

© Modern Astrology 2010 ~ all rights reserved

~~

http://www.huffingtonpost.com/2010/11/19/how-banks-bought-their-ow_n_786073.html

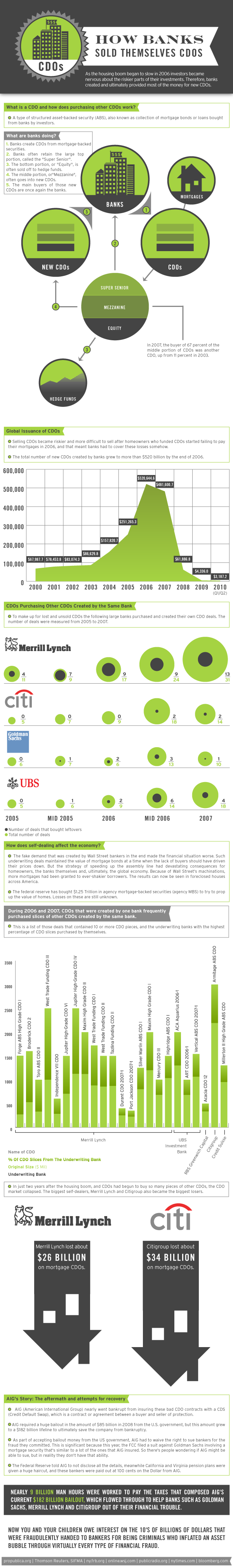

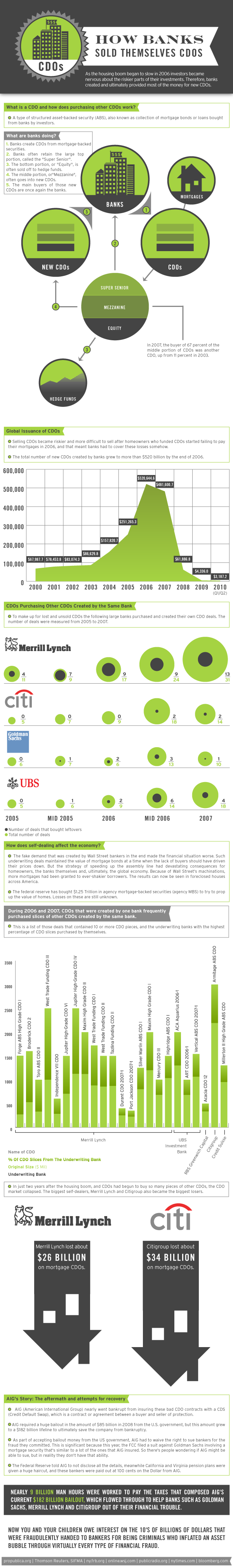

If you're in the market for a detailed, if byzantine, explanation of how banks ended up repackaging and buying their own own securities during the housing boom, we've got you covered.

This infographic, courtesy of MortgageRates lays out some of the details unearthed in a sweeping ProPublica investigation in August. To boost demand for complex mortgage securities called "collateralized debt obligations" (CDOs) some banks resorted to selling these same deals to their own company. (Hat tip to Felix Salmon.)

"In analysis by research firm Thetica Systems, commissioned by ProPublica, shows that in the last years of the boom, CDOs had become the dominant purchaser of key, risky parts of other CDOs, largely replacing real investors like pension funds. By 2007, 67 percent of those slices were bought by other CDOs, up from 36 percent just three years earlier. The banks often orchestrated these purchases. In the last two years of the boom, nearly half of all CDOs sponsored by market leader Merrill Lynch bought significant portions of other Merrill CDOs."

For a graphical look at how this work see below: